Signature Collection

Explore SignatureDubai’s real estate market continues to defy expectations, delivering remarkable growth and solid returns in Q2 2025. Driven by rising demand, strategic developments, and investor confidence, the city remains one of the world’s most dynamic property hubs.

This Dubai real estate market report 2025 offers crucial insights into the latest Dubai property market trends, helping both investors and homebuyers make informed decisions. Whether you’re planning your next home purchase or exploring Dubai real estate investment 2025, understanding these recent trends is essential to spotting opportunities and navigating the path ahead.

Key Highlights from Dubai’s Q2 2025 Property Performance

- Dubai recorded 49,606 property transactions in Q2 2025, marking an 82% increase compared to Q2 2023, with a total value of AED 147.6 billion.

- The average sale price reached AED 2.98 million in Q2 2025, marking a 15.3% increase over two years.

- Dubai introduced new incentives for first-time buyers, including reduced registration fees and easier financing, boosting demand in the mid-tier housing segment.

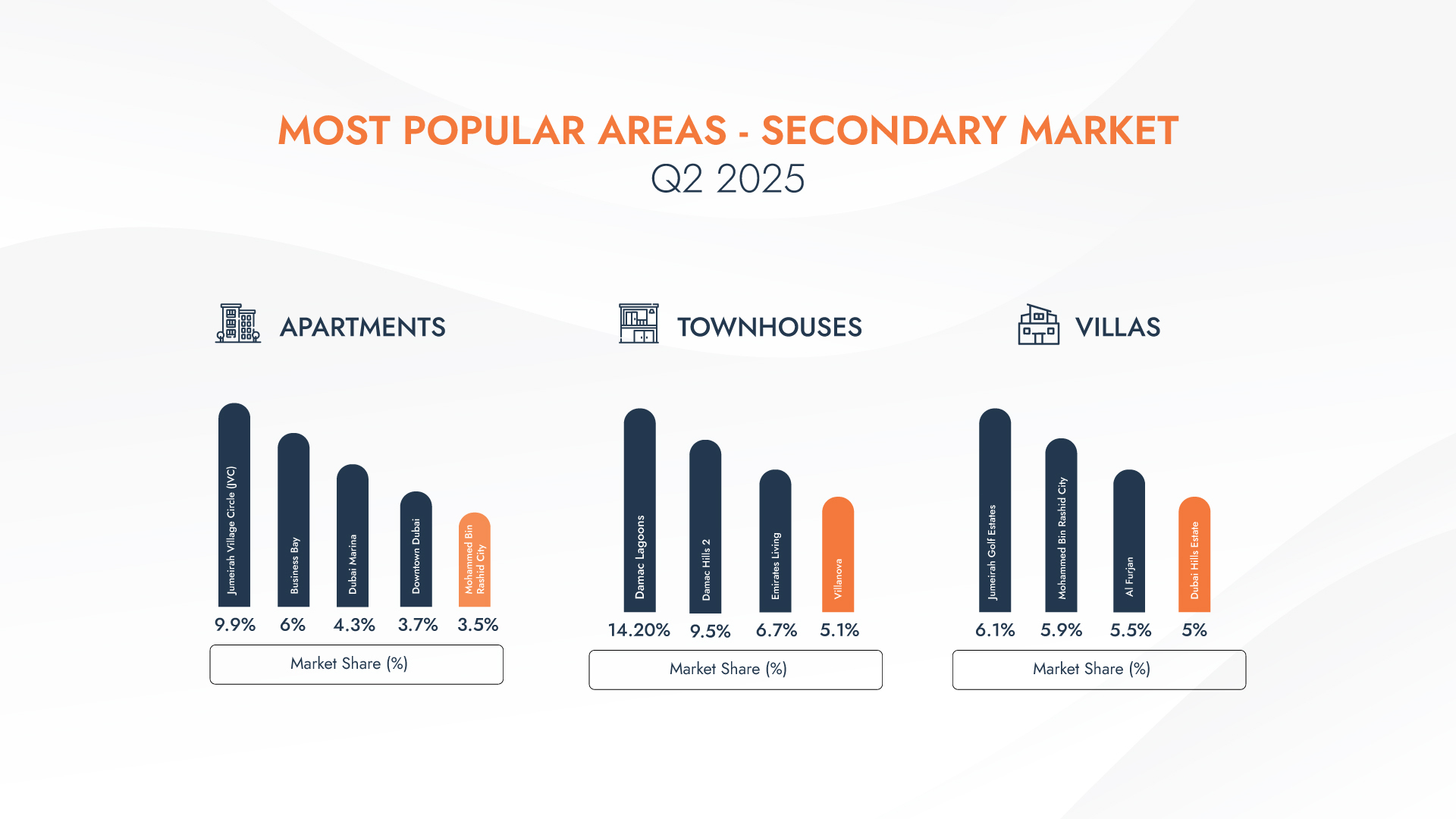

- Popular locations for resale apartment transactions include Jumeirah Village Circle (JVC), Business Bay, Dubai Marina, Downtown Dubai, and Mohammed Bin Rashid City.

- Off-plan sales remained strong with 32,472 registrations in Q2 2025, led by high activity in JVC, Business Bay, and Dubai Production City.

- A total of 81,084 new units are expected to be handed over in 2025, with JVC, Al Furjan, Business Bay, and Emaar Beachfront among the busiest areas.

How Did Dubai’s Real Estate Market Perform in Q2 2025?

According to the Dubai Real Estate Q2 Report, Dubai’s property market recorded 49,606 transactions, marking an 82% increase compared to the same period in 2023. The total value of these transactions reached AED 147.6 billion. The average sale price climbed to AED 2.98 million, showing a 15.3% increase over two years, while the average price per square foot stood at AED 1,823.

For comparison, in Q2 2023, there were 27,204 transactions worth AED 70.2 billion, with an average sale price of AED 2,581,249 and an average price per square foot of AED 1,617. In Q2 2024, 40,510 transactions were recorded with a total value of AED 103.9 billion, an average sale price of AED 2,564,893, and an average price per square foot of AED 1,710.

These figures confirm that Dubai property market trends remain firmly on an upward path, offering stability and promising opportunities for buyers and investors alike.

In a bid to make homeownership more accessible, Dubai also rolled out new incentives for first-time buyers during Q2 2025. These measures include reduced registration fees and easier financing, which are expected to fuel demand in the affordable and mid-tier segments throughout the second half of the year.

Resale Market Highlights

While off-plan sales continue to boom as a cornerstone of Dubai’s real estate market, one standout shift in the Dubai property market Q2 2025 is the remarkable surge in the resale (secondary) market. More buyers and investors are choosing ready properties alongside off-plan opportunities for several reasons:

- Ready homes often offer competitive value per square foot, making them attractive alternatives for certain buyers.

- Immediate rental returns attract investors looking for cash flow.

- End-users prefer moving in without waiting for construction.

This growing interest in resale properties has translated into significant transaction numbers and activity across different segments of the market. Here’s a closer look at how apartments, townhouses, and villas performed in Dubai’s resale market during Q2 2025.

Resale Apartments

In Q2 2025, the resale market for apartments was vibrant, with 16,925 apartments sold. The average price stood at AED 1,857,462, with an average price per square foot of AED 1,689, and an average size of 1,012 square feet. One-bedroom apartments led the market, capturing a 34.9% share of sales. Notably, 16.8% of apartment transactions were priced between AED 1,000,000 and AED 1,500,000.

Top areas for resale apartments included Jumeirah Village Circle (9.9%), Business Bay (6%), Dubai Marina (4.3%), Downtown Dubai (3.7%), and Mohammed Bin Rashid City (3.5%).

Resale Townhouses

Townhouses saw robust activity in Q2 2025’s resale market, with 2,454 transactions recorded. The average price for townhouses was AED 3,279,153, while the average price per square foot was AED 1,341. Both 3-bedroom and 4-bedroom townhouses shared an equal 40% share of sales. Additionally, 41% of townhouse transactions fell within the AED 3,000,000 to AED 5,000,000 range.

Top locations for resale townhouses included Damac Lagoons (14.2%), Damac Hills 2 (9.5%), Emirates Living (6.7%), and Villanova (5.1%).

Resale Villas

Villas maintained strong performance in the resale market during Q2 2025, with 1,121 transactions recorded. The average villa price reached AED 12,181,138, with an average price per square foot of AED 2,223. 4-bedroom villas were the most popular, accounting for 36.4% of sales, while an overwhelming 92.6% of villa transactions were valued above AED 3,200,000.

Key areas for villa resale transactions were Jumeirah Golf Estates (6.1%), Mohammed Bin Rashid City (5.9%), Al Furjan (5.5%), and Dubai Hills Estate (5%).

For anyone exploring Dubai real estate investment 2025, the resale market presents attractive opportunities with immediate income potential, complementing the ongoing appeal of Dubai’s thriving off-plan segment.

Off-Plan Market Insights

Absolutely. Despite the growing interest in the resale market, off-plan sales continue to be a major force in Dubai’s real estate market. Buyers are drawn to off-plan opportunities for modern designs, flexible payment plans, and the potential for capital appreciation.

However, it’s important to note that off-plan sales figures can sometimes be difficult to judge accurately because transactions only become visible once they’re officially registered with Oqood, a process that can take up to two months after the actual sale. For instance, Creek Waters in Creek Harbour launched on 31st March 2023, but registrations only appeared in records on 26th June 2023.

That’s why the Dubai real estate Q2 report provides a clearer picture than monthly snapshots, offering more accurate insights into off-plan performance. According to the Dubai property market Q2 2025 data, there were 32,472 total off-plan registrations, compared to 16,904 resale registrations during the same period.

Here’s how different segments of the off-plan market performed in Q2 2025:

Off-Plan Apartments

In Q2 2025, Dubai recorded 26,252 off-plan apartment registrations. The average price for these apartments was AED 2,114,848, with an average price per square foot of AED 1,987 and an average built-up area of 940 square feet.

One-bedroom apartments dominated the off-plan segment, accounting for 43.5% of registrations, while two-bedroom apartments made up 24.4%. Interestingly, 29.2% of off-plan apartments were priced in the AED 1,000,000 to AED 1,500,000 range.

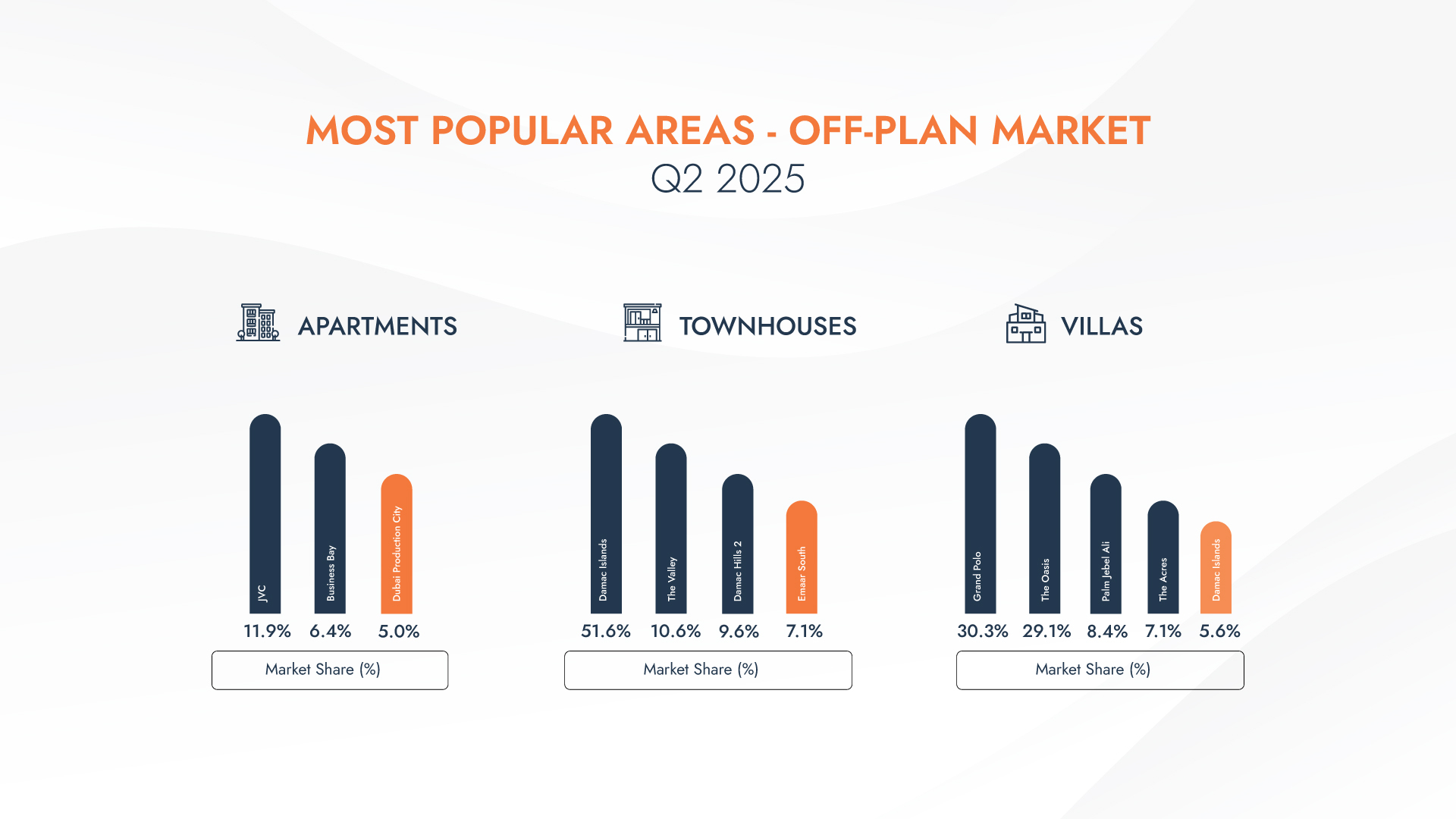

Top locations for off-plan apartment registrations included Jumeirah Village Circle (11.9%), Business Bay (6.4%), and Dubai Production City (5%).

Off-Plan Townhouses

The off-plan townhouse segment saw 3,716 registrations in Q2 2025. The average price for these townhouses was AED 3,058,842, with an average built-up area of 2,578 square feet.

4-bedroom townhouses were the most popular choice, representing 59.1% of transactions, while 3-bedroom units accounted for 11%. Additionally, 45.7% of townhouse sales were in the AED 2,000,000 to AED 3,000,000 price range.

Top areas for off-plan townhouse sales were Damac Islands (51.6%), The Valley (10.6%), Damac Hills 2 (9.6%), and Emaar South (7.1%).

Off-Plan Villas

Off-plan villas continued to attract buyers in Q2 2025, with 2,504 transactions recorded. The average price of these villas was AED 13,230,091, and the average built-up area was 6,466 square feet.

4-bedroom villas accounted for 38.4% of sales, followed by 5-bedroom villas at 33.8%, and 3-bedroom villas at 10.4%. Impressively, 98.1% of off-plan villa transactions were for properties priced above AED 3,200,000.

Leading locations for off-plan villa registrations included Grand Polo (30.3%), The Oasis (29.1%), Palm Jebel Ali (8.4%), The Acres (7.1%), and Damac Islands (5.6%).

Is Dubai’s Property Supply Keeping Pace with Demand?

Dubai’s property supply pipeline remains robust, aligning with the city’s 2040 Vision for sustainable growth and urban development. In 2025, 81,084 properties are expected to be handed over, while 2,121 units are still under launch status and another 22,426 units remain less than 20% complete, making it unlikely they will be delivered by year-end.

Key Handover Locations in 2025

- Jumeirah Village Circle (JVC) is set to receive 7,652 apartments, where demand slightly exceeds supply, with only a 3% gap between leads and listings. The most searched keywords here are brand new, ready to move, and vacant.

- In Al Furjan, 696 apartments, 246 villas, and 440 townhouses are expected. The area consistently receives more leads than listings, often double for apartments. Villas and townhouses see 40% more inquiries than available properties, with popular keywords like brand new, pool, vastu, and standalone.

- Arabian Ranches 3 will see 859 villas and townhouses handed over, where current demand aligns closely with supply.

- The Valley will deliver 638 townhouses and is known for some of the highest returns on equity in affordable housing. Demand remains equal to supply, with brand new, corner, pool, and single-row being the most searched features.

- Damac Lagoons has 5,637 villas and townhouses planned, though demand data is not yet available due to the newness of the project.

- Emaar Beachfront will see 824 apartments handed over, where 2025 has shown 20% more searches than listings and 15% more leads than listings.

- In Business Bay, 5,312 apartments are expected. The market here is balanced, with equal supply and demand, and top searches include Burj Khalifa views, ready-to-move status, brand new properties, and canal views.

Future Supply Outlook: 2026–2028

Looking further ahead:

- In 2026, 96,500 properties are expected, including 82,732 apartments concentrated in Arjan, Business Bay, City Walk, and Dubai Creek Harbour. Villas will primarily be delivered in Dubai Hills Estate and Damac Lagoons, alongside communities such as Damac Hills 2 and Arabian Ranches 3.

- In 2027, Dubai anticipates 84,979 properties, featuring over 16,000 villas and townhouses in Damac Lagoons, Damac Hills 2, Nad Al Sheba, and The Valley.

- In 2028, around 45,480 properties are planned, focusing on Dubai Harbour (Beachfront), Maritime City, Al Sufouh, Damac Lagoons, and Dubai Hills Estate.

Top Searched Areas by Buyers

Understanding buyer interest is crucial for both end-users and investors. According to data from Datafinder.com, the most searched areas for apartments are:

- Dubai Marina (9.8%)

- Jumeirah Village Circle (9.1%)

- Downtown Dubai (8.5%)

- Business Bay (7.6%)

- Palm Jumeirah (4.6%)

Popular keywords for apartments include Ready to Move, Installment, Freehold, Distress, Brand New, and High Floor.

For townhouses and villas, the top searched areas are:

- Dubai Hills Estate (6.6%)

- Dubai Land (5.7%)

- Palm Jumeirah (5.1%)

- Al Furjan (5%)

- Akoya (4.5%)

The most searched features for villas and townhouses include pool, corner, single row, upgraded, brand new, distressed, and vacant.

Strategic Takeaways for Buyers and Investors

The Dubai property market Q2 2025 offers a wealth of opportunities across both ready and off-plan segments. Whether you’re a homebuyer looking for your next move or an investor planning your Dubai real estate investment 2025, staying informed about Dubai property market trends ensures you can make confident, strategic decisions in one of the world’s most exciting real estate markets.

FAQs

Dubai recorded 49,606 property transactions in Q2 2025, an 82% increase compared to Q2 2023. The total value reached AED 147.6 billion, with an average property price of AED 2.98 million.

While off-plan sales remain strong, Q2 2025 saw a remarkable rise in resale activity. Buyers are attracted to ready properties for their competitive pricing, immediate rental income, and quick move-in options.

Top resale apartment areas include Jumeirah Village Circle (JVC), Business Bay, and Dubai Marina. For off-plan sales, JVC, Dubai Production City, and Business Bay were the most active.

Dubai introduced reduced registration fees and easier financing options in Q2 2025 to support first-time buyers, particularly in the mid-tier housing segment.

In 2025, 81,000+ units are set for handover. From 2026 to 2028, over 227,000 new units are expected across major communities like Dubai Hills Estate, Damac Lagoons, and Arjan.

For more information, get in touch with us at Provident

Apartments

Apartments Villas

Villas Townhouses

Townhouses Penthouses

Penthouses Commercial

Commercial See All Properties

See All Properties Commercial

Commercial Property Management

Property Management List Your Property

List Your Property Mortgages

Mortgages Conveyancing

Conveyancing Short Term Rentals

Short Term Rentals Property Snagging

Property Snagging Partner Program

Partner Program Currency Exchange

Currency Exchange PRYPCO

PRYPCO Ethnovate

Ethnovate Plots

Plots